Conservative writer David Frum put together a small polling operation at a Tea Party rally a few years ago and asked a few dozen of them questions about the taxes they pay to the Federal Government.

The results were quite interesting, and worth a look.

Click here to read Bruce Bartlett's take on Frum's findings. Bartlett, a former staffer at the Treasury Department as well as a former member of the Reagan White House, also has served with former Congressman Jack Kemp and Ron Paul in advisory roles.

If you read anything this weekend, read this...

Source:

http://www.forbes.com/2010/03/18/tea-party-ignorant-taxes-opinions-columnists-bruce-bartlett.html

A blog dedicated to the reasonable, rational and tolerant discussion of today's issues...With a focus on Politics, let's discuss it, shall we?

Showing posts with label Taxes. Show all posts

Showing posts with label Taxes. Show all posts

Saturday, July 13, 2013

Monday, April 15, 2013

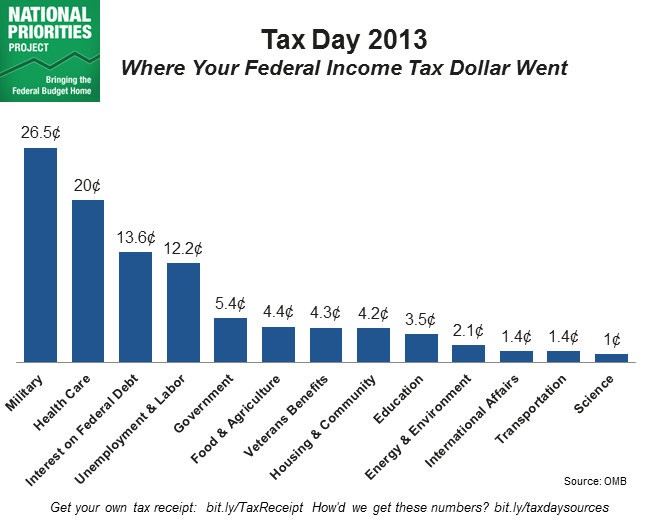

Where our Federal Income Taxes Go...

Today, Monday, April 15th, 2013 is known affectionately as "Tax Day." All citizens of the United States who qualify in terms of earned income must report and file a tax return (or apply for an extension) by the end of today. The above graph, based on data gathered from the Office of Management and Budget, shows us where and how our tax dollars are used.

You can find more detailed information soon, I think when the White House activates its "Your 2013 Federal Taxpayer Receipt" link, which they've provided to all of us for the last few years. You can see the 2012 information here: Your 2012 Federal Taxpayer Receipt.

I'm on record as saying we should, in general be paying higher taxes. Especially after we address the loopholes and subsidies that many of us enjoy to the point of exploitation. Sometimes good stuff costs money. And, yes, of course, we should continue to seek out and eliminate waste and fraud in government spending.

(We have not yet discussed this, but I suspect my partner Mr. Dickinson may feel differently. I look forward to discussing this in person with him later this week when Reasonable Conversation convenes its first ever staff meeting at a local watering hole while Tim visits the Buckeye State on other business.)

(We have not yet discussed this, but I suspect my partner Mr. Dickinson may feel differently. I look forward to discussing this in person with him later this week when Reasonable Conversation convenes its first ever staff meeting at a local watering hole while Tim visits the Buckeye State on other business.)

Friday, November 16, 2012

Bush Tax Cuts: Obama Should Let Them Expire...

The Bush Tax cuts are scheduled to expire as of January 1st, 2014. If nothing is done, that means taxes go up on everyone who pays income tax.

President Obama is on the record supporting extending the Bush cuts for all earners below $250,000 per year and most small businesses. Obama does want to raise taxes on those earners above $250K, back to approximately the Clinton era levels, but with a maximum level of about 38%.

Republican leaders are holding fast to their position of new tax increases for anyone, period.

President Obama holds most of the cards in this game of poker.

He could try and negotiate a deal with the Republicans, but that seems unlikely given the rigidness of the GOP over time on the issue of raising taxes. Even a little. Republicans say they're willing to consider new revenue, but they mean more in the ways of closing tax loopholes, although they're not being at all specific, at least not yet.

Mr. Obama has almost begged for an agreement on the 98% of the issue both parties agree about. That taxes should not be raised on the lower and middle class. So far, he's been told no.

The good news for the President is that he needs to do nothing. If he waits for the Bush tax cuts to expire, then with everyone getting a tax increase, we can trust that in no time at all there will be a democratic Bill submitted for a tax cut for the lower and middle class. The GOP can agree to it or not.

If they agree to it, Obama and the Dems get what they've wanted all along.

If they refuse to cooperate, they get to explain to the most of the American people why they are voting against a tax break for them.

Thursday, October 27, 2011

Tired of 47% not paying any taxes? Shame on us...

I hear this complaint daily. On talk radio, on Fox, on facebook, etc. The basic message is this:

"The 47% of us who pay no taxes are really getting over on the rest of us that do! It's wrong, it's un-American and somebody should do something about it!"

First off, let's get some specifics...

Its hard to think of a person in the US who's over 18 and doesn't pay some kind of taxes. Our income is taxed, we contribute to Social Security and Medicare. We pay sales taxes in most states. We pay taxes on gasoline, cigarettes, alcohol, etc. Homeowners pay property taxes. Residents of many local communities pay school taxes. And on and on. To be fair, the vast, vast, vast majority of us pay some taxes. The complaint I mentioned above is most commonly, in my opinion, applied to those who don't pay Federal Income taxes. Its also fair to say that the revenues that come from those "other" taxes like gasoline, cigarettes, property, school taxes, etc. don't go directly to the US Treasury Department.

Let's even agree that some percent of the 47% who allegedly pay "no taxes" may be breaking the law for tax evasion. To that rather small group that does break the law, they should be charged with crimes and given stiff sentences and pay all the back taxes, plus fines they owe. Period. Make them also pay for the costs of prosecuting them as well.

So now we're down to the actual percent of people who "legally" pay no Federal Income tax. Via our current tax code, there are exemptions and deductions which are perfectly legal. The Earned Income Tax Credit, can dramatically reduce the amount a lower income family is required to pay on their taxable income. Standard deductions can lop off over ten grand from a family's taxable income.

As a result, many families pay very little or no income tax at all. The suggestion that this group of Americans is somehow free-loading off the rest of us is unfair. These are typically lower income families who aren't living in $500,000.00 homes or vacationing in Monaco. Most of us wouldn't trade places these families. Would we? Still, despite most of these people who aren't paying any taxes following the laws, many look upon this group as free-loading, leech-like, parasites slowly but surely stealing all the good stuff from those of us who pay taxes.

This week, two of the Republican candidates for President made announcements on their tax plans. Herman Cain, he of the 9-9-9 plan, announced that those living under the poverty line would not pay any income tax. Understand that for 2011, this Country defines poverty in terms of a family of four as an income of up to $22, 350 in annual earnings. For those of you complaining that everyone should pay Federal income taxes, is it safe to say that Herman Cain's tax plan is not satisfactory?

Governor Rick Perry of Texas also had a big announcement this week about his plans to address taxes in the United States. He proposes a "flat tax" that features a 20% standard flat rate and a $1250.00 per family member deduction. Suggesting that a family of four who makes $50,000.00 a year, or less, would pay zero taxes. Is that acceptable to those who are tired of people not paying any income taxes? There are other concerns about Perry's plan such as the effect of dangerously reducing the amount of revenues into the Federal government, and the deceptive "simplicity" claimed by the Perry camp.

These plans will be tweaked over time and we'll see new ones from the other candidates before too long. Regardless of what they present, there will be some group of Americans who won't have to pay Federal income tax. Not because they're free loaders, deadbeats, parasites, etc., but because the various tax plans in this Country ALL provide for some measure of relief for those who earn the least among us.

I wish the mean spirited rhetoric I've heard about "this group" destroying the country would stop. I expect the RW media to engage in that kind of partisan fear mongering and hate speech, but when I see regular people saying it around town, on facebook, etc. it disgusts me. Maybe they haven't really looked into why so many aren't paying federal income taxes or in some cases very little. With higher real unemployment than we can accurately measure, of course incomes are down. If income levels are down, so will be the amount of taxes owed. Trust me, the quality of life is also down for this group of people. They're probably not heading out to the best restaurants in town this weekend. Probably having hot dogs, or tv dinners for the umpteenth time this month. The Liberal media plays its own version of this game, just not nearly as well. All people that are wealthy aren't selfish pigs. Its brutal from either side.

The contempt I've read and listened to from "regular folk" towards this target group is disturbing. It speaks to the growing polarization of our Right and Left. Our Wealthy and Poor. The Have's and the Have Nots. Its harmful, its mean and its doing damage to us as a people. While the media loves to play winners and losers, especially in politics, to see it creep into the fabric of our citizenry will be a thing to regret in time.

Its no way to treat each other.

Sources:

http://finance.yahoo.com/news/Nearly-half-of-US-households-apf-1105567323.html

http://www.taxationlawfirms.com/resources/tax/tax-fraud-and-tax-evasion/negligence-vs-tax-fraud.htm

http://www.irs.gov/individuals/article/0,,id=96466,00.html

http://en.wikipedia.org/wiki/Standard_deduction

http://www.hermancain.com/999plan

http://thehill.com/video/campaign/189059-cain-says-those-under-poverty-line-exempted-from-9-9-9-income-tax

http://en.wikipedia.org/wiki/Federal_poverty_level#Recent_poverty_rate_and_guidelines

http://www.rickperry.org/cut-balance-and-grow-html/#fix-tax-code

Tuesday, October 25, 2011

It was fine then, but is unacceptable now...

It was fine then..

but is unacceptable now...

Is this another example of Republicans doing an about face on policy matters? (Individual mandate, anyone?) Any attempt to directly compare these two clips on a one for one basis is likely a flawed one, but it does speak to a general attitude. It shouldn't be dismissed as irrelevant. Fact is, President Ron Reagan did raise taxes and is still widely lauded as one of our finest Presidents. Even the man's detractors don't usually focus on his "over taxing" as a main complaint. (Under taxing, yes...)

Twenty years later, things are very different in our Country. Unemployment is higher, our manufacturing sector is shell of its former self and many, many of the jobs lost over the last few decades aren't ever coming back. To suggest that because a president did something two decades ago that's its the exact right thing to do now is wrong minded. It might be, it might not be.

On the other hand, those who feel President Obama is out to destroy our Country by increasing some high earner's income tax, as well as closing some corporate tax loopholes, which are akin to tax increases for business in some circles, are over the top. When President Reagan rolled out his two proposals, The Tax Equity and Fiscal Responsibility Act of 1982 (wow, that almost sounds socialist, doesn't it?) and then the Highway Revenue Act of 1982, many protested. Were they successful? I'll leave that up to you as my point is that the world kept spinning, Old Glory still looked awesome flying above and for the most part, America didn't lose a single shred of any of its essence.

We should be able to find something slightly more subtle than THE IMPENDING DESTRUCTION OF OUR LAND when making the case that a tax hike is or isn't the right way to go.

Let's cool it...

Sources:

http://www.bloomberg.com/news/2011-07-22/democrats-recall-reagan-s-tax-increases.html

http://en.wikipedia.org/wiki/Tax_Equity_and_Fiscal_Responsibility_Act_of_1982

http://en.wikipedia.org/wiki/Highway_Revenue_Act_of_1982

but is unacceptable now...

Is this another example of Republicans doing an about face on policy matters? (Individual mandate, anyone?) Any attempt to directly compare these two clips on a one for one basis is likely a flawed one, but it does speak to a general attitude. It shouldn't be dismissed as irrelevant. Fact is, President Ron Reagan did raise taxes and is still widely lauded as one of our finest Presidents. Even the man's detractors don't usually focus on his "over taxing" as a main complaint. (Under taxing, yes...)

Twenty years later, things are very different in our Country. Unemployment is higher, our manufacturing sector is shell of its former self and many, many of the jobs lost over the last few decades aren't ever coming back. To suggest that because a president did something two decades ago that's its the exact right thing to do now is wrong minded. It might be, it might not be.

On the other hand, those who feel President Obama is out to destroy our Country by increasing some high earner's income tax, as well as closing some corporate tax loopholes, which are akin to tax increases for business in some circles, are over the top. When President Reagan rolled out his two proposals, The Tax Equity and Fiscal Responsibility Act of 1982 (wow, that almost sounds socialist, doesn't it?) and then the Highway Revenue Act of 1982, many protested. Were they successful? I'll leave that up to you as my point is that the world kept spinning, Old Glory still looked awesome flying above and for the most part, America didn't lose a single shred of any of its essence.

We should be able to find something slightly more subtle than THE IMPENDING DESTRUCTION OF OUR LAND when making the case that a tax hike is or isn't the right way to go.

Let's cool it...

Sources:

http://www.bloomberg.com/news/2011-07-22/democrats-recall-reagan-s-tax-increases.html

http://en.wikipedia.org/wiki/Tax_Equity_and_Fiscal_Responsibility_Act_of_1982

http://en.wikipedia.org/wiki/Highway_Revenue_Act_of_1982

Tuesday, October 18, 2011

Should we stop funding Liberal Arts Education with public dollars?

Florida Governor Rick Scott, citing shrinking financial resources, supports a strategy that would showed preferred funding for Science, Technology, Engineering and Math programs (STEM). Governor Scott says, "If I’m going to take money from a citizen to put into education then I’m going to take that money to create jobs,” Scott said. “So I want that money to go to degrees where people can get jobs in this state."

The Governor is expected to include several different reforms aimed at Colleges and Universities across Florida when he submits his new budget next January. With more money being provided to the STEM majors, less funds will be available for Liberal Arts majors, plus some other "science" based fields of study such as Psychology and Anthropology. “Is it a vital interest of the state to have more anthropologists? I don’t think so.” says, Governor Scott.

Now's probably a good time to mention that Governor Scott's daughter, Jordan Kandah, earned an Anthropology degree from William & Mary College. She did not work in the field, rather was a Special Education teacher before enrolling in a MBA program earlier this Fall.

As fun as that sounds, its not really evidence that Scott's policy is hypocritical or would even be a bad one.

As I understand it, students would'nt be prevented from study Liberal Arts, they just wouldn't get as much public dollars via student grants and loans to do so. This wouldn't effect Scholarships or other private sources of tuition assistance.

I don't profess to know how the coffers for Florida higher education look at this moment. In general, with the shape of the economy, rising health care costs, unemployment's effect on the tax base, etc. it doesn't sound crazy to me to accept Scott's premise that there is less money to go around. The State is trying to direct its limited financial resources toward those fields of study that can lead to the highest paying jobs (i.e. produce the biggest financial payoff) for Florida.

The Governor is advocating for closer scrutiny for how the Public dollars are spent. That's not a bad thing.

As to the question of is it dangerous to have the Government start picking winning and losing Majors to back differently? Good question. Is there evidence that Florida is running short on STEM majors? Or the Country for that matter?

Some say yes....

Some say no...

I believe we absolutely need Liberal Arts majors to graduate and fill Society's needs for teachers, Psychologists and sure, Anthropologists. As income disparity worsens, the harshness of basic living is becoming more and more difficult. I say life is getting harder, not easier. As the world continues to shrink, the entire dynamic of how higher education, economics and our work-force interact is changing. Technology has replaced so many jobs in the labor pool, there aren't enough jobs to go around. Incomes are depressed, "savings" is hard to achieve when you have trouble paying your bills in the first place.

I believe we need better teachers, especially in the Journalism and English fields. Via the advance of the internet, more people are able to summon vast amounts of information on the subject of their choosing. The rub is, content from the internet, even from well known websites that advertise themselves as "THE place for News", or more "fair and balanced" than those other guys, isn't always accurate or impartial. Too often, people get their information...and develop subsequent opinions on an issue...from an agenda driven, biased news operation. Its difficult and time consuming to do research on topic, consider both sides viewpoints, fact check, etc. The more trained we are in reading, critical thought, etc. the better prepared we will, as a people, be able to cut through the noise and make decisions based on the facts of an issue.

We need smart people to help figure out our Country's future. I say we need both STEM people and Liberal Arts people taking their best collective whack at it.

It'll be a while before we can see the effect of Governor Scott's education reform, if it even survives through to the final budget. If it succeeds as designed, and unemployment spikes down in Florida, especially in the STEM fields, then the State will benefit in many ways. Will it justify the expected drop off in Liberal Arts education? Time will tell. At the point in time a shortage of available Liberal Arts degreed people is identified, the need would easily be filled by bringing in professionals from out of state. If its bad enough, perhaps a future Governor will adjust higher education funding once more.

Sources:

http://htpolitics.com/2011/10/10/rick-scott-wants-to-shift-university-funding-away-from-some-majors/

http://htpolitics.com/2011/10/12/rick-scotts-daughter-has-anthropology-degree/

http://www.politifact.com/truth-o-meter/statements/2011/jul/05/united-fair-economy/liberal-group-says-family-incomes-grew-equally-pri/

http://www.msnbc.msn.com/

http://www.foxnews.com/

http://www.usatoday.com/tech/science/2009-07-08-science-engineer-jobs_N.htm

http://www.livecareer.com/news/Education/Obama-We-Need-More-Scientists-and-Engineers_$$00753.aspx

Friday, October 14, 2011

Herman Cain's 9-9-9 Tax Plan...(Reading List)

9-9-9

Here's a collection of articles from the web discussing it...

Herman Cain's website 9-9-9 Tax Plan details...

Daily Caller story regarding "Club for Growth" endorsement of 9-9-9...

Daily Caller Op-Ed in support of 9-9-9...

Paul Ryan endorses 9-9-9 plan as a "good starting point for debate"...

Wall Street Journal looks at pros/cons...

Wall Street Journal on creation of the plan, role of Art Laffer, Reagan influence...

Washington Post looks at the effect of 9-9-9 on a average income home and a wealthy one...

Washington Post Op-Ed against 9-9-9...

Miami Herald writes that business groups call 9-9-9 a job killer...

The Hill describes 9-9-9 as taking fire from all sides...

Sources:

http://www.hermancain.com/999plan

http://dailycaller.com/2011/10/14/club-for-growth-chief-backs-9-9-9/

http://dailycaller.com/2011/10/14/cains-9-9-9-plan-manna-from-heaven-for-conservatives/

http://dailycaller.com/2011/10/13/paul-ryan-loves-herman-cains-9-9-9-tax-plan/

http://online.wsj.com/article/SB10001424052970204774604576627440442708356.html?mod=WSJ__MIDDLESecondStories

http://online.wsj.com/article/SB10001424052970204774604576629433751126652.html?mod=WSJ_Election_LEFTSecondStories

http://www.washingtonpost.com/blogs/ezra-klein/post/the-9-9-9-plan-for-an-average-household-and-for-a-wealthy-one/2011/08/25/gIQAGKYzhL_blog.html?wpisrc=nl_wonk

http://www.washingtonpost.com/blogs/ezra-klein/post/there-is-no-such-thing-as-the-9-9-9-tax/2011/08/25/gIQAiIhWhL_blog.html?wpisrc=nl_wonk

http://www.miamiherald.com/2011/10/14/2453903/business-groups-call-cains-9-9.html

http://thehill.com/blogs/on-the-money/domestic-taxes/186409-cains-9-9-9-tax-reform-plan-comes-under-fire-from-left-and-right

Location:

Troy, OH 45373, USA

Wednesday, August 10, 2011

Here come cuts to defense spending...

House Speaker John Boehner and Minority Leader Mitch McConnell have released the six names of the "Super-Committee" that will work on coming up with mutually agreed upon budget cuts to the tune of $1.5 Trillion dollars over the next decade.

From the House, Dave Camp (R-MI), Fred Upton (R-MI) and Jeb Hensarling (R-TX) have been named along with Jon Kyl of Arizona, Pat Toomey of Pennsylvania and Rob Portman of Ohio from the Senate.

All have signed Grover Norquists anti tax pledge which reads:

Taxpayer Protection Pledge

I, _____, pledge to the taxpayers of the (____ district of the) state of ______ and to the American people that I will: ONE, oppose any and all efforts to increase the marginal income tax rate for individuals and business; and TWO, oppose any net reduction or elimination of deductions and credits, unless matched dollar for dollar by further reducing tax rates.

So much for bipartisanship and compromise...Somehow I knew Olympia Snowe wasn't going to be chosen...

Stand by Pentagon officials for your marching orders in several weeks...

Sources:

http://www.politico.com/news/stories/0811/61028.html

http://s3.amazonaws.com/atrfiles/files/files/070711-federalpledgesigners.pdf

From the House, Dave Camp (R-MI), Fred Upton (R-MI) and Jeb Hensarling (R-TX) have been named along with Jon Kyl of Arizona, Pat Toomey of Pennsylvania and Rob Portman of Ohio from the Senate.

All have signed Grover Norquists anti tax pledge which reads:

Taxpayer Protection Pledge

I, _____, pledge to the taxpayers of the (____ district of the) state of ______ and to the American people that I will: ONE, oppose any and all efforts to increase the marginal income tax rate for individuals and business; and TWO, oppose any net reduction or elimination of deductions and credits, unless matched dollar for dollar by further reducing tax rates.

So much for bipartisanship and compromise...Somehow I knew Olympia Snowe wasn't going to be chosen...

Stand by Pentagon officials for your marching orders in several weeks...

Sources:

http://www.politico.com/news/stories/0811/61028.html

http://s3.amazonaws.com/atrfiles/files/files/070711-federalpledgesigners.pdf

Tuesday, May 10, 2011

Speaker Boehner, we really do need an adult conversation about our Debt...

"I think it’s time for us as Americans to have an adult conversation with each other about what’s driving the debt." (John Boehner, R-OH, Economic Club of New York, May 9, 2011)

That's fine with me, Mr. Speaker.

We're fast approaching the time when we need to raise our debt ceiling or face very bad repercussions around the world. We've done it before many times and now is not the time to stop. No one disputes we need to address our debt, only how. Historically, its been a combination of both cuts in spending and tax increases that have yielded the best results.

With your statement that "everything is on the table except for tax increases," you suggest that everything we desire can be attained by cutting expenses in a variety of areas. I don't believe you believe that. While you trot out faithfully the "the American people deserve an adult conversation" line, you drag the conversation into a different direction entirely. Perhaps less political posturing and more adult-like behavior might produce results more appealing to the American People.

After cutting taxes, Republican leaders, led by Bob Dole, convinced President Reagan tax increases were necessary to a recovery in the 80's. Reagan took the advice, raised taxes and helped improve the US economy. George HW Bush infamously raised taxes as well as Bill Clinton. The world did not end, the sky did not fall and we had a pretty good run after those tax increases.

That said, according to the Bureau of Economic Analysis, Americans paid the lowest percent in taxes since 1958. That's fifty-three years ago. In 2010, we paid 23.6% of our income in combined Federal, State and Local taxes compared to 27% which we paid between the years of 1970 through 1999. That 3.4% reduction equates to roughly 500 billion dollars for our various government coffers.

The decline in tax percent is attributable to two main factors. Lower tax rates and lower tax revenues caused by high unemployment of recent years. Both President Bush's (#43) and President Obama's tax cuts have contributed to this negative effect on revenues.

President Reagan's own Budget Director, David Stockman, has stated that trickle down economics do not work. Further, he's no fan of the Bush tax cuts whatsoever. He's got plenty of dislike for Democratic fiscal policy, as well.

Previous tax increases have helped in the past and they could help now. We need a smart blend of aggressive and comprehensive spending cuts AND tax increases. Surely a true "adult conversation" could convince most Americans its time to address our debt from both ends, just like they do. The average American household experiencing financial problems seeks not just to cut expenses, but they also look for ways to increase the amount of money coming into the home. Its what the Country should do.

Quickly...

Sources:

http://www.hamreport.com/2011/05/john-boehner-says-he-wants-trillions-in.html?spref=tw

http://finance.yahoo.com/blogs/daily-ticker/boehner-no-tax-hikes-pledge-completely-incomprehensible-ft-145656288.html%20?sec=topStories&pos=8&asset=&ccode=

http://www.nytimes.com/2004/06/08/opinion/the-great-taxer.html?pagewanted=1

http://www.usatoday.com/money/perfi/taxes/2011-05-05-tax-cut-record-low_n.htm

http://www.nytimes.com/2010/08/01/opinion/01stockman.html

That's fine with me, Mr. Speaker.

We're fast approaching the time when we need to raise our debt ceiling or face very bad repercussions around the world. We've done it before many times and now is not the time to stop. No one disputes we need to address our debt, only how. Historically, its been a combination of both cuts in spending and tax increases that have yielded the best results.

With your statement that "everything is on the table except for tax increases," you suggest that everything we desire can be attained by cutting expenses in a variety of areas. I don't believe you believe that. While you trot out faithfully the "the American people deserve an adult conversation" line, you drag the conversation into a different direction entirely. Perhaps less political posturing and more adult-like behavior might produce results more appealing to the American People.

After cutting taxes, Republican leaders, led by Bob Dole, convinced President Reagan tax increases were necessary to a recovery in the 80's. Reagan took the advice, raised taxes and helped improve the US economy. George HW Bush infamously raised taxes as well as Bill Clinton. The world did not end, the sky did not fall and we had a pretty good run after those tax increases.

That said, according to the Bureau of Economic Analysis, Americans paid the lowest percent in taxes since 1958. That's fifty-three years ago. In 2010, we paid 23.6% of our income in combined Federal, State and Local taxes compared to 27% which we paid between the years of 1970 through 1999. That 3.4% reduction equates to roughly 500 billion dollars for our various government coffers.

The decline in tax percent is attributable to two main factors. Lower tax rates and lower tax revenues caused by high unemployment of recent years. Both President Bush's (#43) and President Obama's tax cuts have contributed to this negative effect on revenues.

President Reagan's own Budget Director, David Stockman, has stated that trickle down economics do not work. Further, he's no fan of the Bush tax cuts whatsoever. He's got plenty of dislike for Democratic fiscal policy, as well.

Previous tax increases have helped in the past and they could help now. We need a smart blend of aggressive and comprehensive spending cuts AND tax increases. Surely a true "adult conversation" could convince most Americans its time to address our debt from both ends, just like they do. The average American household experiencing financial problems seeks not just to cut expenses, but they also look for ways to increase the amount of money coming into the home. Its what the Country should do.

Quickly...

Sources:

http://www.hamreport.com/2011/05/john-boehner-says-he-wants-trillions-in.html?spref=tw

http://finance.yahoo.com/blogs/daily-ticker/boehner-no-tax-hikes-pledge-completely-incomprehensible-ft-145656288.html%20?sec=topStories&pos=8&asset=&ccode=

http://www.nytimes.com/2004/06/08/opinion/the-great-taxer.html?pagewanted=1

http://www.usatoday.com/money/perfi/taxes/2011-05-05-tax-cut-record-low_n.htm

http://www.nytimes.com/2010/08/01/opinion/01stockman.html

Subscribe to:

Posts (Atom)